U.S. Intermodal Container Traffic

By Rene Circ at Grubb and Ellis.

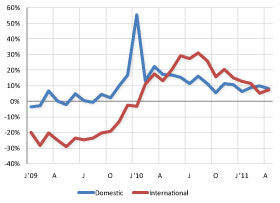

During the first week of a new quarter, when the previous quarter’s statistics are old news and new numbers are not yet available, the newly released statistics by the Intermodal Association of North America might provide some insight into the industrial real estate market. In April, traffic of domestic containers rose 7.9 percent year-over-year, while international container traffic increased by 7.4 percent. April was the first month of the year showing a decline in the rate of growth for domestic containers, and also an acceleration of growth for international containers.

A closer look at the underlying numbers reveals two interesting findings. First, international trade is a lot more volatile than domestic production. During the entire recession, there were only four months of negative year-over-year growth in domestic container activity, with the largest decline being 3.7 percent. International containers show 13 consecutive months of contractions, declining by as much as 28.3 percent in February of 2009. The Inland Empire industrial property market, which is primarily driven by international trade, showed a similar volatility and steep declines in 2009, while today it is the fastest growing market in the country. Since different capital sources have varied tolerance of risk, market volatility needs to be incorporated into every investment strategy.

Second, the overall growth numbers are strong. In the first quarter, the movement of domestic containers outpaced the overall economy by 400 percent, while international containers beat GDP by 500 percent. This spread in growth confirms that supply chains are ever-evolving and their reconfigurations will continue to create activity in the industrial real estate sector.

Rene Circ

National Director of Research, Industrial

312.224.3962